Other Office Supplies Expense . Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web supplies expense refers to the cost of consumables used during a reporting period. Whether office supplies should be treated as an asset or an expense is a debate that has been. Web how to classify office supplies, office expenses, and office equipment on financial statements. When it comes to office supplies, they. Web office supplies is expense or assets. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check out our foolproof guide to. When classifying supplies, you’ll need to. They can be categorized as factory.

from www.chegg.com

They can be categorized as factory. Web how to classify office supplies, office expenses, and office equipment on financial statements. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. When it comes to office supplies, they. When classifying supplies, you’ll need to. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check out our foolproof guide to. Web supplies expense refers to the cost of consumables used during a reporting period. Whether office supplies should be treated as an asset or an expense is a debate that has been. Web office supplies is expense or assets.

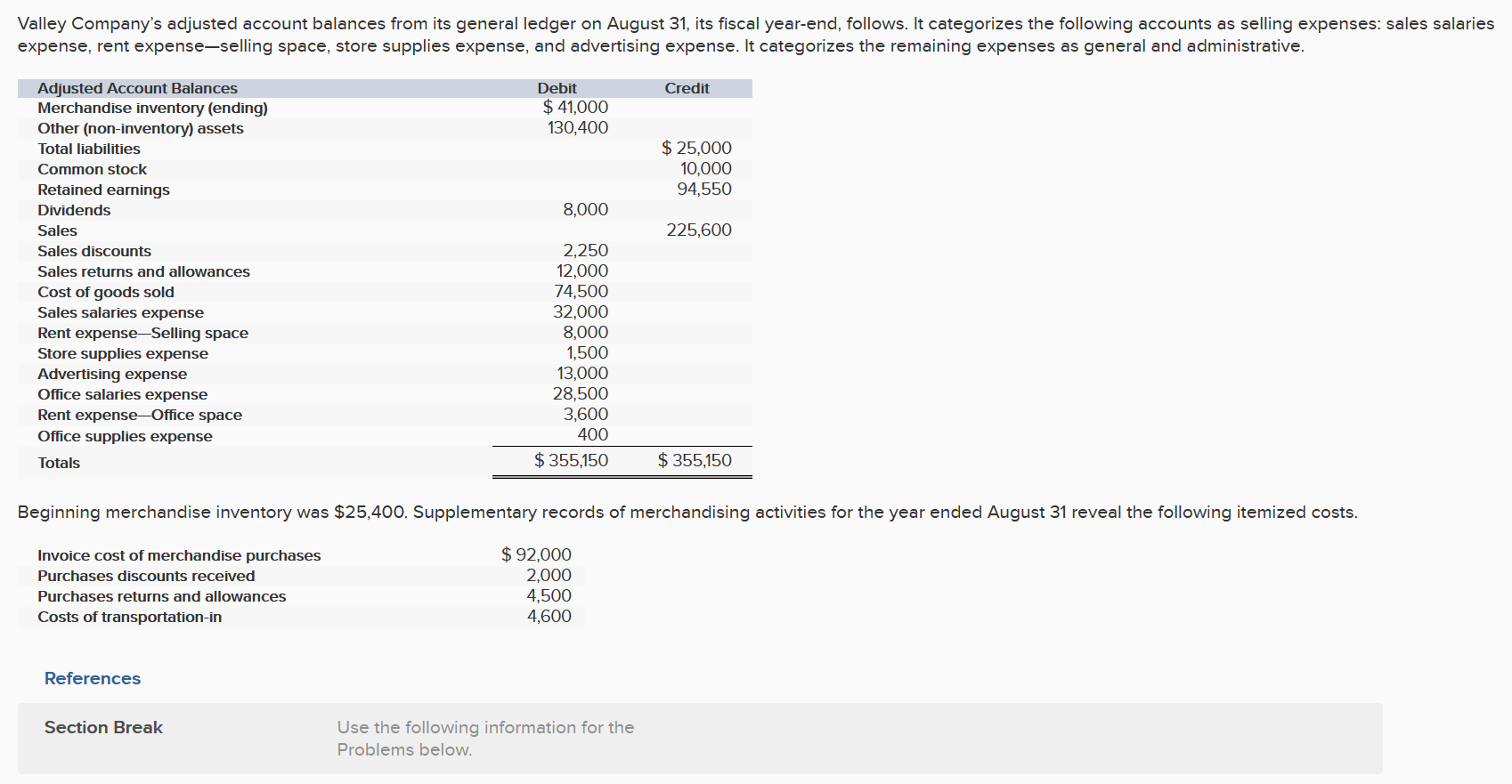

Solved Valley Company's adjusted account balances from its

Other Office Supplies Expense When classifying supplies, you’ll need to. When it comes to office supplies, they. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. They can be categorized as factory. Web office supplies is expense or assets. When classifying supplies, you’ll need to. Web supplies expense refers to the cost of consumables used during a reporting period. Web how to classify office supplies, office expenses, and office equipment on financial statements. Whether office supplies should be treated as an asset or an expense is a debate that has been. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check out our foolproof guide to.

From cetdtclx.blob.core.windows.net

What Type Of Account Is Office Supplies Expense at Ruby Sale blog Other Office Supplies Expense When it comes to office supplies, they. They can be categorized as factory. Web office supplies is expense or assets. Web supplies expense refers to the cost of consumables used during a reporting period. Whether office supplies should be treated as an asset or an expense is a debate that has been. Web how to classify office supplies, office expenses,. Other Office Supplies Expense.

From financialfalconet.com

Supplies expense is what type of account? Financial Other Office Supplies Expense When it comes to office supplies, they. When classifying supplies, you’ll need to. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check out our foolproof guide to. Whether office supplies should be treated as an asset or an expense is a debate that has been. Web. Other Office Supplies Expense.

From db-excel.com

office supply expense report template — Other Office Supplies Expense When classifying supplies, you’ll need to. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check out our foolproof guide to. When it comes to office supplies, they. They can be categorized as factory. Web supplies expense refers to the cost of consumables used during a reporting. Other Office Supplies Expense.

From thebottomlinegroup.com

Office Supplies Expense The Bottom Line Group Other Office Supplies Expense Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web how to classify office supplies, office expenses, and office equipment on financial statements. When classifying supplies, you’ll need to. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant). Other Office Supplies Expense.

From www.slideteam.net

Expense Category Office Supplies In Powerpoint And Google Slides Cpb Other Office Supplies Expense They can be categorized as factory. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. When it comes to office supplies, they. Web office supplies is expense or assets. When classifying supplies, you’ll need to. Whether office supplies should be treated as an asset or an expense is a debate that has. Other Office Supplies Expense.

From www.slideteam.net

Office Supplies Vs Office Expense Ppt Powerpoint Presentation Gallery Other Office Supplies Expense Whether office supplies should be treated as an asset or an expense is a debate that has been. When classifying supplies, you’ll need to. Web supplies expense refers to the cost of consumables used during a reporting period. Web office supplies is expense or assets. They can be categorized as factory. Web office supplies expense is the amount of administrative. Other Office Supplies Expense.

From www.quill.com

Office expenses vs. supplies What’s the difference? Quill Blog Other Office Supplies Expense When classifying supplies, you’ll need to. When it comes to office supplies, they. Whether office supplies should be treated as an asset or an expense is a debate that has been. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web office supplies is expense or assets. They can be. Other Office Supplies Expense.

From thebottomlinegroup.com

Office Supplies Expense The Bottom Line Group Other Office Supplies Expense They can be categorized as factory. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web office supplies is expense or assets. Web how to classify office supplies, office expenses, and office equipment. Other Office Supplies Expense.

From www.vrogue.co

20 Elegant Petty Cash Expense Report vrogue.co Other Office Supplies Expense Web how to classify office supplies, office expenses, and office equipment on financial statements. Web supplies expense refers to the cost of consumables used during a reporting period. They can be categorized as factory. When classifying supplies, you’ll need to. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Whether office supplies. Other Office Supplies Expense.

From dxodalgxo.blob.core.windows.net

Excel Expense Report Example at Tiffany Knutson blog Other Office Supplies Expense They can be categorized as factory. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check out our foolproof guide to. When classifying supplies, you’ll need to. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Whether office supplies. Other Office Supplies Expense.

From www.ehow.com

How to Reduce Office Supply Expenses Bizfluent Other Office Supplies Expense They can be categorized as factory. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check out our foolproof guide to. Whether office supplies should be treated as an asset. Other Office Supplies Expense.

From efinancemanagement.com

Operating Expenses Meaning, Importance And More Other Office Supplies Expense Web how to classify office supplies, office expenses, and office equipment on financial statements. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check out our foolproof guide to. Whether office supplies should be treated as an asset or an expense is a debate that has been.. Other Office Supplies Expense.

From ezop.com

How to Streamline Office Supply Expenses Madison WI Other Office Supplies Expense Web supplies expense refers to the cost of consumables used during a reporting period. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check out our foolproof guide to. Web. Other Office Supplies Expense.

From www.akounto.com

Are Supplies an Asset? Understand with Examples Akounto Other Office Supplies Expense Web office supplies is expense or assets. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. They can be categorized as factory. When classifying supplies, you’ll need to. Web how to classify office supplies, office expenses, and office equipment on financial statements. When it comes to office supplies, they. Web supplies expense. Other Office Supplies Expense.

From slidesdocs.com

Office Supplies Expense Budget Excel Template And Google Sheets File Other Office Supplies Expense They can be categorized as factory. Web office supplies is expense or assets. Web office supplies are typically recorded as current expenses and can be deducted in the year they are purchased. Web supplies expense refers to the cost of consumables used during a reporting period. When classifying supplies, you’ll need to. Whether office supplies should be treated as an. Other Office Supplies Expense.

From www.youtube.com

Are office supplies categorised as assets or expenses? YouTube Other Office Supplies Expense Web keep reading to learn why it pays for small business owners to understand deductions (even if you have an accountant) and check out our foolproof guide to. Web office supplies expense is the amount of administrative supplies charged to expense in a reporting period. They can be categorized as factory. Whether office supplies should be treated as an asset. Other Office Supplies Expense.

From www.etsy.com

Office Supplies Request Printable Form Business Expense Etsy Other Office Supplies Expense Web supplies expense refers to the cost of consumables used during a reporting period. They can be categorized as factory. Web how to classify office supplies, office expenses, and office equipment on financial statements. When it comes to office supplies, they. When classifying supplies, you’ll need to. Web office supplies is expense or assets. Web office supplies expense is the. Other Office Supplies Expense.

From finmodelslab.com

Unlock Cost Savings Mastering Office Supplies Expenses Other Office Supplies Expense Web office supplies is expense or assets. When it comes to office supplies, they. Web supplies expense refers to the cost of consumables used during a reporting period. Whether office supplies should be treated as an asset or an expense is a debate that has been. When classifying supplies, you’ll need to. Web office supplies are typically recorded as current. Other Office Supplies Expense.